Smart Financial Preparation: Reliable Strategies for Save for College

Navigating College Expenses: Specialist Financial Preparation Guidance for Pupils

As college tuition remains to increase, pupils are encountered with the complicated task of browsing their expenses. From tuition fees to textbooks and living costs, the monetary concern can be overwhelming. With experienced financial preparation advice, trainees can properly manage their funds and make the many of their college experience. In this conversation, we will discover various approaches for understanding university expenses, producing a budget plan, checking out monetary help choices, minimizing products and books, and managing living expenditures. By implementing these professional tips, students can take control of their economic journey and set themselves up for success in their scholastic searches.

Understanding College Costs

Understanding college costs is critical for students and their family members in order to make informed financial decisions and prepare for the costs related to college. University expenditures incorporate a large range of economic obligations that trainees require to take into consideration prior to getting started on their academic journey. These expenditures consist of tuition costs, holiday accommodation prices, textbooks and supplies, meal strategies, transport, and assorted costs.

Tuition fees are typically the biggest expense for pupils, and they vary depending on aspects such as the kind of organization, program of study, and residency standing. Materials and textbooks can likewise be a substantial expenditure, especially for programs that require specific products.

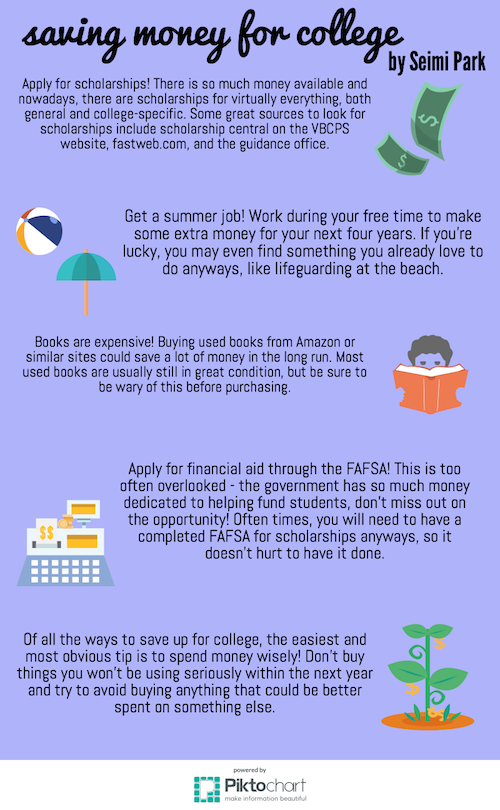

To gain a thorough understanding of university costs, students and their households ought to investigate the details expenses connected with the institutions and programs they are taking into consideration. They ought to likewise explore possible resources of financial assistance, scholarships, gives, and work-study possibilities to assist counter some of these expenses. By recognizing university expenses, pupils can make informed decisions concerning their economic future and ensure that they are adequately prepared to meet the monetary needs of higher education.

Producing a Spending Plan

To effectively manage college costs, students and their families need to develop a spending plan that accounts for all economic responsibilities and ensures responsible spending throughout their academic journey. Creating a budget is a crucial action in financial planning, as it allows people to track their revenue and expenditures, and make educated decisions about their investing habits.

The initial step in developing a spending plan is to establish all income sources. This might include scholarships, grants, part-time jobs, or contributions from household participants. Save for College. It is vital to have a clear understanding of the complete quantity of money available each month

Following, pupils must determine all required expenses, such as tuition costs, books, housing, transportation, and food. It is essential to focus on these expenditures and designate funds as necessary. In addition, pupils ought to likewise take into consideration reserving money for emergencies or unanticipated expenses.

Once earnings and costs are determined, it is essential to track spending on a routine basis. This can be done via budgeting applications or easy spread sheets. By monitoring expenditures, pupils can identify areas where they may be spending beyond your means and make modifications as necessary.

Producing a spending plan not just helps pupils remain on track monetarily, but it additionally promotes accountable spending behaviors that can be carried right into the future. By developing a budget plan and sticking to it, trainees can browse their college costs with self-confidence and ease.

Exploring Financial Assistance Options

Among one of the most typical forms of economic help is scholarships. Scholarships are awarded based on scholastic merit, athletic accomplishments, or other details requirements. They do not require to be settled, making them an attractive option for many students. It is very important for pupils to study and request scholarships that align with their certifications and interests.

Grants are one more kind my site of financial help that does not require payment. These are generally granted based on monetary need and are given by the federal government, state governments, or universities themselves. Pupils should finish the Free Application for Federal Student Aid (FAFSA) to identify their eligibility for grants.

Last but not least, student finances are another choice for funding college costs. Unlike scholarships and gives, fundings have to be repaid with rate of interest. Pupils ought to meticulously consider their car loan choices and obtain just what is necessary to avoid extreme financial debt.

Reducing Textbooks and Materials

As trainees check out financial assistance alternatives to reduce the problem of university expenditures, locating ways to save on textbooks and supplies ends up being important (Save for College). Textbooks can be a significant expenditure for pupils, with rates frequently getting to hundreds of bucks per publication. There are a number of methods that students can utilize to conserve money on these necessary sources.

One method to conserve on books is to take into consideration leasing them instead of buying them outright. Numerous on the internet platforms and blog school book shops use book rental solutions at a portion of the expense of buying brand-new publications. An additional alternative is to acquire made use of books. Several university universities have book shops or on the internet industries where trainees can offer and purchase used textbooks, often at considerably reduced prices.

Pupils can likewise explore digital choices to physical textbooks. E-books and on-line resources are becoming significantly prominent, providing students the comfort of accessing their needed analysis products digitally. In addition, some sites use cost-free or low-priced textbooks that can be downloaded and install or accessed online.

In terms of supplies, students can save cash by purchasing in bulk or benefiting from back-to-school sales. It is additionally worth contacting the college or university's bookstore for any type of discount rates or promotions on supplies. Students ought to consider obtaining materials from friends or classmates, or making use of campus resources such as libraries and computer system laboratories, which frequently supply accessibility to necessary materials at no expense.

Taking Care Of Living Expenses

Managing living costs is a critical aspect of university economic preparation - Save for College. As a student, it is essential to produce a budget plan that makes up all your crucial living expenses, such as housing, food, transportation, and utilities. By handling these costs successfully, you can make certain that you have adequate cash to cover your standard demands and stay clear of unneeded economic stress

One means to handle your living expenses is to discover cost effective real estate choices. Additionally, discover various meal strategy alternatives or prepare your own meals to conserve money on food expenses.

To properly manage your living expenses, it is critical to track your costs and produce a monthly spending plan. This will certainly help you recognize areas where you can reduce and save cash. Try to find student price cuts or totally free events on school for home entertainment alternatives that will not spend a lot.

Conclusion

To conclude, comprehending college expenditures and creating a budget plan are crucial steps for students to efficiently handle their financial resources. Exploring monetary aid options and finding methods to save on materials and textbooks can likewise help ease a few of the monetary problem. Furthermore, handling living costs is necessary for trainees to stay on track with their finances. By executing these strategies, students can browse university costs and enhance their financial well-being.

By understanding college expenses, students can make informed decisions about their financial future and ensure that they are effectively prepared to fulfill the economic needs of greater education.

As trainees explore financial aid alternatives to alleviate the burden of university expenditures, locating methods to save on products and books ends up being important.